Tax Rules for Company Cars

Tax Rules for Company Cars Discussed by Hayvenhursts Accountancy Services

New tax rates for electric and hybrid company cars were introduced by the UK government as of 6th April 2020. With the rates changing in 2021, 2022 and again in 2023, the new rules could save your business and employees a huge amount of money when it comes to company cars tax payments.

What does this mean?

The latest changes means it is time to seriously consider changing to an electric vehicle if you can. The changes mean significant benefits and tax savings for both employers and employees when it comes to company cars.

The changes have been made to support the government’s Climate Change agenda and targets. The reduction in company car tax is one of the ways the Government is pushing us all to be greener. What better way is there to support the reduction of climate change by driving a green electric vehicle, as well as the added benefit of it saving you money at the same time?

Summary

- Company car tax is also known as Benefit in Kind Tax (BiK)

- BiK is calculated based on the P11D value of the vehicle and its CO2 tailpipe emissions, as well as the employee’s tax rate threshold

- The BiK tax rate is set by HM Treasury and is collected through PAYE, pay as you earn salary

- Considerable BiK savings can be made by choosing a low or zero-emissions electric vehicle compared to an equivalent petrol or diesel vehicle

- Preferential BiK taxation rates last until at least 2025 making fully electric and lower-emission plug-in hybrid electric vehicles much more cost-efficient and compelling than ever when it comes to company cars

What is Company Car Benefit in Kind (BiK)?

A company car is taxed depending on two things; its list price and its CO2 emissions. Both of these figures create a ‘taxable benefit in kind’ (BiK) that employers and employees pay tax and national insurance contributions (NI) on.

Over the last 6 years benefit in kind (BiK) tax rates for both petrol and diesel vehicles has seen an increase. Since the introduction and now the accessibility of electric and hybrid cars from most car manufacturers, the BiK rates for more fuel-efficient, electric and hybrid vehicles has seen a decrease as the government’s way of encouraging greener vehicles and the UK working towards its climate change targets.

As an example:

A typical company car owner could be spending between £300 – £500 a month if they are a 40% taxpayer and they are driving a petrol or diesel vehicle with average emissions.

At the moment the upfront cost of an electric vehicle is more than a petrol or diesel-powered vehicle, however, if the cost and the greener element works for the business buyer or leaser then the tax decreases will be a benefit over the lifetime of the lease time of the vehicle.

The New Tax Rates for Electric and Hybrid Cars

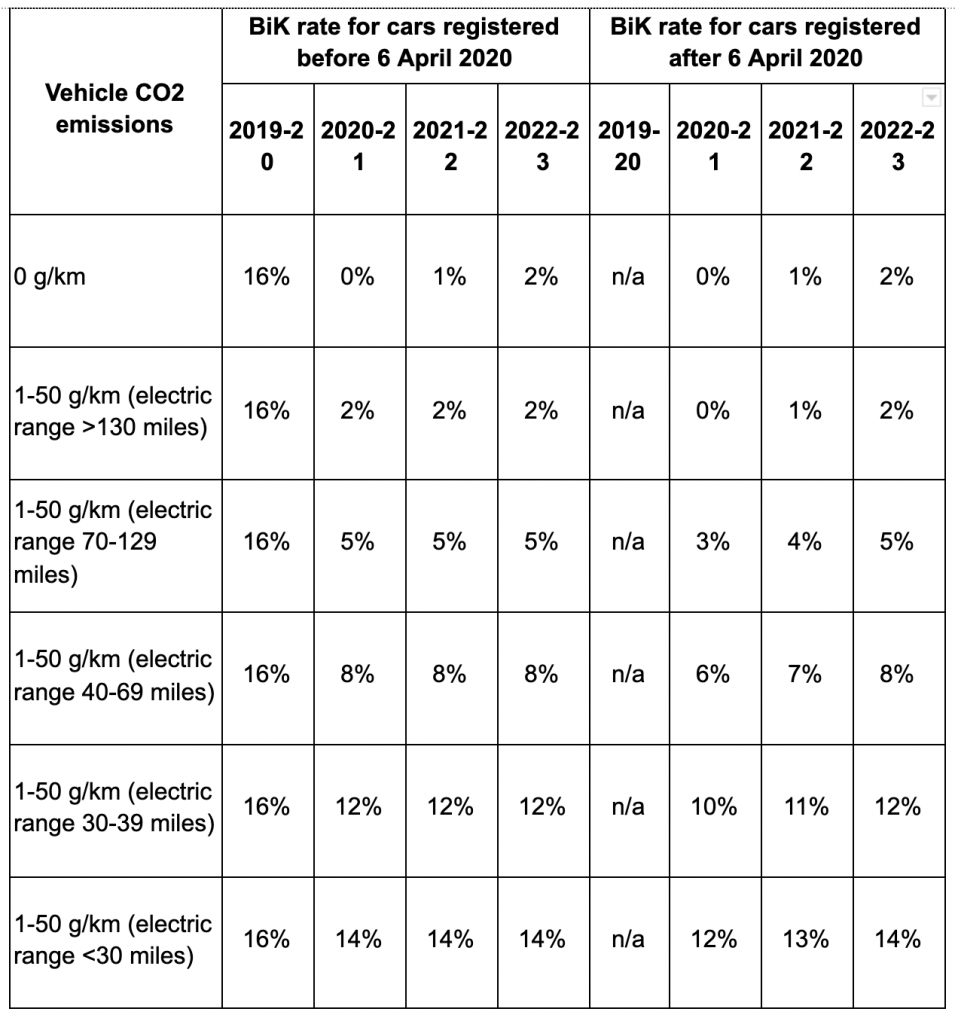

As of 6th April 2020 new BiK tax rates were introduced for electric and hybrid company cars which could save your business and employees a huge amount when it comes to Company Car Taxes.

The new tax rates calculate the cost of the vehicle as well as its CO2 emissions.

The tax rates are based on how many miles the car can drive on battery power alone whilst producing between zero and 50g/km of carbon dioxide. As an example, for a car that can drive more than 130 miles on battery power and produces between 0 and 50g/km of carbon monoxide the BIK rate is 1% for 2021/2022 and then 2% for the subsequent tax year 2022/23.

What are the Other Benefits of an Electric or Hybrid Company Car?

Capital Allowances for Electric Vehicles

You can claim capital allowance on cars you buy and use within your business. This means you can deduct part of the value of the car from your profits before you pay tax.

This allows you to deduct the full purchase price of a brand new electric vehicle from your pre-tax profits, as long as its emissions are 0g/km. This is known as 100% First Years Capital Allowance as opposed to claiming relief at 18%/6% over a number of years. Electric vehicles are also exempt from Vehicle Excise Duty.

Example:

A vehicle costing approximately £40,000 can result in tax relief of £7,600 in the first year of being purchased.

You can go to https://www.gov.uk/capital-allowances/business-cars to find out more.

Congestion Charge Exemptions

Electric vehicles are exempt from congestion charge tax. This means if your company vehicles are regularly travelling in areas where clean air zones exist or could soon be introduced, this is added tax savings for your business over a year.

Example:

The congestion tax in London is currently at £11.50 per day per vehicle between the hours of 07:00 and 18:00 Monday through to Friday. This is a significant saving for one vehicle let alone a fleet of vehicles which travel in and out of London.

Road Tax

Vehicle road tax is now based on carbon dioxide emissions and the recent changes mean that 100% electric cars are free from tax in their first year.

In addition to this, cars registered from between 31st March 2017 and 1st March 2001 with CO2 emissions less than 100 g/km are not subject to road tax.

For any vehicles registered on or after 1st April 2017 car tax has increased.

100% electric vehicles have no tailpipe emissions and are therefore still exempt from road tax, any plug-in hybrid electric cars with CO2 emissions less than 100 g/km will pay between £0-£135 for road tax annually. The amount of road tax paid depends on the vehicle’s CO2 emission levels.

A point to remember, all cars registered on or after 1st April 2017 whose value was over £40,000 are still required to pay an additional road tax charge whatever their carbon emissions.

These Benefits can result in Significant Savings for an Employer or Employee Running an Electric Vehicle Compared to an Equivalent Petrol or Diesel Model.

The savings offered by changing to electric vehicles depends on many different factors, however, the government has made the tax savings a significant reason to consider the change and going green. Changing to an electric company car or a fleet of electric vehicles also adds to your businesses green credentials.

The below figures show you the Benefit in Kind (BiK) rates for vehicles with less than 50 g/km CO2 emissions before and after 6 April 2020 including Electric, Petrol and RDE2 Diesel.

Hayvenhurst Accountancy Team

The team at Hayvenhursts will be happy to discuss these Company Car and other tax saving options which you are eligible for when you are self employed or if you have your own business.

We have experts in all aspects of accountancy and will put an accountancy team together for you to match your business and its needs.

We can help you with your personal and business finances and we don’t just offer a standard accountancy service. We commit to getting to know you and your business and we will work with you to ensure your business has all the accountancy and expert business services that you need, whether you are a startup or a long standing business.

We work alongside our customers to identify tax relief, savings, tax breaks, improved cash flow and business efficiency through our defined and relevant accountancy and business services, establishing savings and opportunities which will improve your business’s short and long term prospects.

We offer a personal and professional service focused on the needs of each individual customer, business or family across South Wales and the whole of the UK.

Choosing an accountant has never been so important when it comes to your finances.

Our Services:

- Accounts Preparation

- Audits

- Bank Accounts

- Book-keeping

- Book-keeping Health Check

- Business Growth

- Business Health Check

- Business Plans

- Business Valuations

- Commercial Property

- Company Formation

- Company Secretarial

- Contractors and IR35

- Furlough Advice

- Inheritance Tax Planning

- Management Accounts & Information

- Management Systems

- Pension Tax Relief

- PAYE Health Check

- Payroll & PAYE Returns

- Personal Tax

- Property Tax

- Raising Finance

- Reduce your SRA Audit Costs

- Registered Office

- Strategic Planning

- Tax Disputes

- Tax Enquiries & investigations

- Tax Planning

- Tax Returns & Self-Assessment

- Trusts

- VAT Deferrals

- VAT Temporary Reductions

- VAT Health Check

- VAT Planning & Disputes

- VAT Registration

- VAT Returns

Contact us today and find out how we can help you with your business and personal taxes.